The New York Workforce Housing Trust is a new preservation strategy for rent-stabilized multifamily housing that provides affordable housing for low- and moderate-income families earning 50-80% of Area Median Income. Unlike traditional investment strategies that emphasize raising rents, the Workforce Housing Trust focuses on reducing operating costs by addressing the two largest expenses - property taxes and energy costs. The Housing Trust seeks to generate mid-teen returns for both taxable and tax-exempt investors while preserving affordability and reducing carbon emissions by more than 60%.

Workforce Housing Demand

Sources: 2015 Rent Guidelines Board; "The Growing Gap", NYC Comptroller

New York City's housing market is unable to supply increasing demand with new construction over the past decade meeting less than half of population growth. Unmet demand is driving displacement. Since 1993, rent-stabilized apartments can be deregulated as existing tenants turn over and become unaffordable for most working families. Since 2000, the number of low- and moderate-income households has fallen by 70,000 - a dramatic loss of essential services and skills for the city's economy.

NYC's 845,000 rent-stabilized units are clustered in Manhattan, the Bronx, and western Brooklyn

142,967rent stabilized Units have been deregulated since 2007

Deregulation of rent stabilized apartments has been focused in Core Manhattan neighborhoods

Risky Conventional Investment Strategies

Sources: NYC IBO, Massey Knakal, Ariel Property Advisors

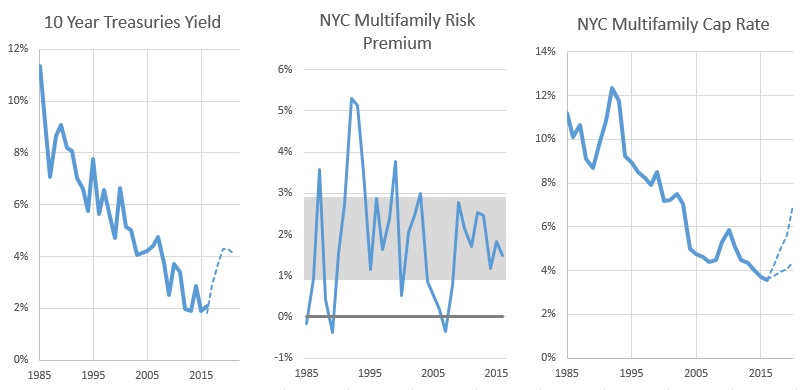

Current multifamily investment strategies are also placing investment capital at significant risk. Recent purchases of multifamily property have nearly returned to the aggressive pricing of the 2000s at the same time as the 2015 Rent Law has reduced returns by limiting the opportunities for deregulating apartments. Interest rates are also expected to double over the medium term. The combined impact may reduce multifamily valuations by up to 40% and will provide improved pricing for transactions.

Investment Strategy

The Workforce Housing Trust will reduce operating expenses by over 30% by reducing taxes and energy costs. Buildings will eliminate real estate taxes under Article XI in exchange for maintaining existing affordability. Energy costs will be reduced by replacing the existing heating and hot water systems and installing rooftop solar. The Workforce Housing Trust achieves the same increase in net operating income in less than 2 years that a conventional strategy achieves in eight. In all, the strategy adds over $40,000 in value to each $200,000 apartment through a combination of energy savings, property tax savings and additional air conditioning revenue at a capital cost less than $18,000.

Efficient Long-Term Preservation of Affordable Housing

Each year 7% of all rent stabilized apartments turn over. With market rents are 20-50% higher, housing becomes increasingly less affordable over time. The Workforce Housing Trust would maintain the existing rental structure as part of an Article XI abatement. Because of the relatively low property taxes in the neighborhoods where the Trust will operate, each affordable unit costs approximately $55,000/unit over 30 years compared the $88,000/unit average cost in the New York City 10 Year Housing Plan.

380,000 targeted units meet income, rent growth, size and height requirements

Targeted Units are located in Upper Manhattan, the Bronx, Brooklyn and Queens

Nearly 40% of investment opportunities are located in 10 city council districts

The Trust will focus its acquisition efforts on 5-6 story buildings with existing rents affordable to families earning up to 120% of area median incomes in neighborhoods and properties with annual rent increases under 6%. 380,000 existing stabilized units meet the Trust's criteria.

Substantial Reduction in Energy Emissions and Cost

The Trust will reduce energy consumption by over 70% and reduce owner energy costs by nearly 50% through an integrated energy-efficiency strategy using distributed energy. The typical apartment buildings wastes nearly one-third of the energy used for heating through distribution losses and combustion losses in the boiler. Replacing a centralized system with individual unit heat pumps eliminates distribution losses and increases efficiency from 68% to 238% in the New York City climate. Heat pumps also allow tenants the option of air conditioning with substantial savings over window units while the Trust earns a significant markup under current state regulations.

Nearly half the energy generated to heat water is wasted especially during the summer when oversized boilers are kept running to generate hot water. Installing tankless heaters in each unit eliminates distribution and storage losses and enables recovery of heat from waste water raising efficiency from 48% to 150%. Nearly 25% of all energy would be generated on-site with rooftop solar utilizing a canopy to cover 75% of roof area with substantial excess production during the peak summer hours. By reducing demand at peak times, solar PV reduces the average price of electricity from $0.20 to $0.13 per kwh - the equivalent of $1.70/gallon for #2 fuel oil accounting for the improved efficiency of heat pumps.

Lastly, air sealing and installation of a green roof would reduce heating and cooling demands by 10%. In all, carbon emissions would be reduced nearly 60% with additional improvements over time as renewable grid energy increases.

Superior Investment Returns with Reduced Risk

The Workforce Housing Trust financially outperforms conventional investment strategies. Traditional strategies generate more than 80% of their returns at sale and are especially risky with rising interest rates. The preservation strategy generates less than 60% of its return at sale with additional returns generated by refinancing and tax credits. In neighborhoods with rent growth under 5%, the preservation strategy increases investment returns up to 600bps. The only scenario in which conventional strategies outperform is an unlikely one where neighborhood rents rise at 5% yet cap rates rise to 6.5% - returning to spreads last seen in the early 1990s.